Will you be required to file a 1099 form with the IRS by January 31? Did your society pay more than $600 during 2021 to any one person for labor or for speaking at a seminar? Did you get a new roof on your library? Pay a plumber, electrician or other workers for repairs or work in or around your library? The amount you paid can include materials but must include some labor. So you paid a plumber to replace a toilet and the total bill was $650 for his labor and the toilet, you need to send him a 1099 NEC form. If you just got materials and then volunteers put them in no 1099 is required.

Did you pay any speaker more than $600 you need to send the speaker a 1099 NEC form.

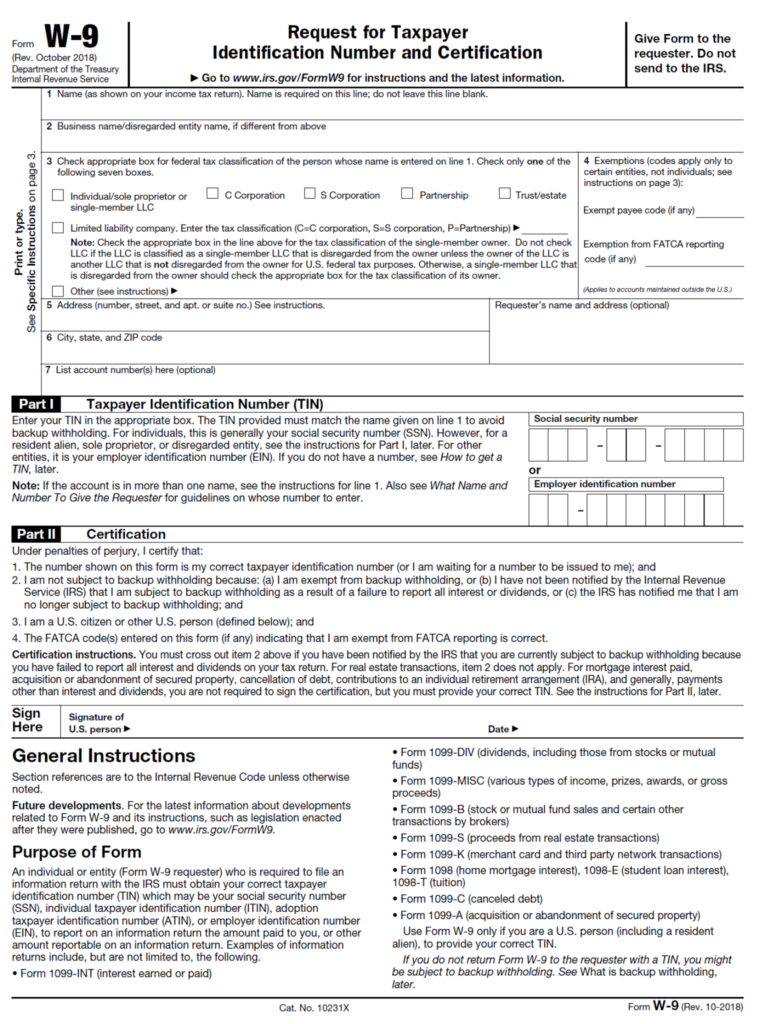

What information do you need for the 1099 NEC form? You need the name and address and social security number of the person that provided the labor or spoke at your society. How do you get that information? The IRS provides a form W9 which you send the person and they fill in the Name, Address and Social Security number they want to be used on the 1099 form. What happens if they refuse to give you their social security number? Don’t pay them till you get it. You also need the amount you paid that person, but your treasurer should have that. Where can you get the 1099 NEC forms? Office Depot has them here where I live, and probably other office supply places might have them. You can order them online also. You will also need a 1096 form which is just like a cover form for the IRS, it has your society name and address and a total of the 1099s. The IRS requires a special red ink for the copy that goes to the IRS, but the other copies are black ink. You send the red copies to the IRS by January 31 and a black copy to the speaker or laborer also by January 31,

Good information for us volunteer Treasurers. THANKS